How Much Money Does The Government Make On Alcohol Taxes

PHILIP J. COOK

Introduction

Alcoholic beverages have been taxed at a relatively high rate throughout the history of the United States. During the last 20 years, however, taxes on beer, wine, and liquor have increased more slowly than the overall price level. The result has been a substantial reduction in the price of alcoholic beverages relative to other commodities. Federal and state alcohol tax policies during this period have thus had the effect of providing an economic incentive for increased drinking. Since alcohol consumption is a contributing factor in the etiology of highway accidents, violent crime, suicide, cirrhosis, and a number of other causes of injury and death, it is possible that the downward trend in the relative price of alcoholic beverages has had the effect of reducing Americans' life expectancies and increasing morbidity.

Does the rate of alcohol taxation in fact have an important influence on rates of morbidity and mortality? There is almost no direct evidence on this question in the social science literature, although the potential importance of alcohol taxation as a public health policy instrument has been discussed in several recent scholarly presentations.1 The most controversial aspect of this question is whether changes in the price of alcohol influence the drinking habits of heavy drinkers; this group accounts for the bulk of alcohol-related problems, and it is widely believed that the drinking habits of this group are insensitive to price.

In this paper, I review available evidence on the price elasticity of demand for alcohol and present a new statistical analysis that tends to support the view that liquor consumption is moderately responsive to price in the United States. More important, I am able to demonstrate with a high degree of certainty that increases in the tax rate on spirits reduce both the auto fatality rate and the cirrhosis mortality rate. The virtually inescapable conclusion is that the demand for alcohol by heavy drinkers is responsive to price.

The next section is a brief history of alcohol taxation, prices, and consumption in the United States since 1950. A review of the econometric literature follows on the price elasticity of demand with new results for the 1960–1975 period using a "quasi-experimental" technique. The next section reviews available results relating alcohol consumption levels to mortality from certain causes and then presents new findings on the impact of alcohol prices on cirrhosis and auto fatalities. The following section discusses the use of excise taxes on alcoholic beverages as part of a public health strategy for reducing alcohol abuse, and the final section presents concluding observations.

Prices and Taxes

While the average prices of beer, wine, and distilled spirits have been increasing during the last two decades, the rates of increase are less than the overall inflation rate. The statistics in Table 1 demonstrate that the price of spirits, relative to the average price of all other consumer goods (as measured by the consumer price index [CPI]), has declined 48 percent since 1960. During the same period, the relative price of beer has declined by 27 percent and wine by about 20 percent.

TABLE 1

Average Prices/Pint of Ethanol, 1960–1980.

We would expect that price reductions of this magnitude, especially when coupled with the substantial increases in average real disposable income during this period, would result in increased consumption. In fact, average consumption of ethanol per person (aged 15 and over) increased 29 percent between 1960 and 1971; since then average consumption has remained roughly constant at about 2.7 gallons of ethanol per year. Figure 1 depicts the recent history of consumption rates for beer, wine, and spirits.

Figure 1

Trends in per-capita ethanol consumption in U.S. gallons, based on beverage sales in each major beverage class in the United States, 1946–1976.

Nominal consumer expenditure for alcoholic beverages increased from $13 billion to $32 billion between 1960 and 1975 (DISCUS Facts Book 1977, p. 26), but this represents an increase in real terms (controlling for inflation) of only 36 percent. The percentage of total consumer expenditures accounted for by alcoholic beverages declined from 3.7 percent to 3.0 percent during this period. Thus the decline in the real cost of all types of alcoholic beverages in recent years has been accompanied by increased consumption but a reduced importance in the typical consumer's budget.

What accounts for the secular decline in the relative prices of alcoholic beverages? Part of the answer, particularly in the case of distilled spirits, is that excise tax rates have not kept up with inflation.

The last three columns of Table 1 were derived from the first three columns, converted to "1980 dollars" by the consumer price index. For example, according to the CPI, 1960 dollars had 2.63 times as much purchasing power as 1980 dollars. Therefore, 1960 prices were converted to 1980 dollars by multiplying in each case by 2.63.

Alcohol Beverage Taxation

Alcoholic beverages are subjected to a complex array of taxes and other controls that affect retail prices. Distilled spirits are taxed more heavily than beer and wine; taxes on distilled spirits include a federal excise tax of $10.50 per proof gallon and state and local taxes and fees that averaged $5.55 per gallon in 1975 (DISCUS 1977a) and import duties on foreign products. Beer and wine are also taxed by all levels of government. As a result, various direct taxes and fees account for about one-half of retail expenditures for spirits and about one-fifth of retail expenditures for both beer and wine (DISCUS 1977a, p. 2).

The states have legislated a considerable degree of government control on alcoholic beverage prices and sales. Nineteen states have a legal monopoly over the wholesale trade in spirits, and all but two of these also monopolize the retail trade in spirits. Most of these monopoly states also require that wine be sold only in state stores, and several have included beer as well.2 In monopoly states, then, prices are set by administrative fiat. In the remaining states, retail distributors must be licensed by the state, and in most of these states the distributors are subject to fair trade controls on pricing. The decline in real prices of alcoholic beverages, then, directly reflects choices made by state legislatures and regulatory agencies. More fundamentally, however, it is clear that these choices have been influenced by costs. A major component of the cost of distilled spirits is the federal excise tax; the fact that it has remained constant at $10.50 per proof gallon for the last 30 years has greatly contributed to the decline in real cost of this type of beverage. If this excise tax had been "indexed" to keep up with inflation since 1960, it would now stand at about $28 per proof gallon; assuming this tax increase had been passed along to the consumer with a 20-percent markup, the real price of spirits would only have declined by about 22 percent since 1960, in contrast with the actual decline of 48 percent.

Thus, prices of alcoholic beverages are controlled by legislation and government agencies to a considerable extent. Tax and regulatory decisions in this area influence patterns of consumption, which in turn influence the public health. The remaining sections of this paper are devoted to developing evidence on the magnitudes of such effects and discussing their implications for pricing policy.

The Demand for Alcoholic Beverages

The prices of alcoholic beverages have had a downward trend since 1960 (compared with the overall price level), while during much of this period average consumption increased. Was the decline in price responsible, at least in part, for the increase in drinking during the 1960s? More generally, how much do economic variables—prices and income levels—influence drinking habits? This question has motivated a number of empirical studies, both in North America and Europe. My review of this literature is limited to a few of the best of these studies based on U.S. or Canadian data. The new results presented below are based on recent data on prices, income, and consumption in the United States. I begin the review with a brief summary of the economic theory and terminology useful to understanding the empirical studies.

Notes on the Economic Theory of Consumption

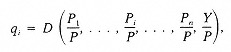

Economic theory demonstrates that an individual's rate of purchase (quantity demanded) for any commodity that he or she consumes will be influenced by the price of the commodity, the prices of related commodities, and by his or her purchasing power (wealth or income). The relationship between the consumer's quantity demanded and these economic variables can be characterized as a mathematical function of the follow form:

(1)

where

View in own window

| q i | = the quantity demanded of commodity i, |

| P 1, …, P n | = prices of the various commodities available, to the consumers, including P i (the "own price"), |

| P | = a price index, such as the consumer price index, |

| Y | = the consumer's income. |

Adjusting prices and income for the overall price level P in this fashion is justified because only relative prices and income matter in determining demand. For example, a uniform increase of 10 percent in all prices and income would have no effect on demand.

Individuals have different tastes, and two consumers facing identical prices and income may differ considerably in the mix of commodities they buy; the mathematical form of the function (1) differs among individuals. However, economic theory predicts that consumers will be alike in their qualitative response to a price change; an increase in price will reduce the quantity demanded.3 It would be surprising if alcoholic beverages proved to be exceptions to this basic principle of economics.

Economics offers some useful terminology for characterizing the shape of a demand function:

- (1)

-

If the quantity demanded of a commodity increases with income, the commodity is termed normal; otherwise it is inferior. Cheap wine of poor quality may be an example of an inferior commodity.

- (2)

-

If two commodities are typically consumed together, one enhancing the utility derived from the other, they are termed complements. More precisely, two commodities are complements if a reduction in the price of one increases the demand for the other. Beer and whiskey are complements for people who consume their alcohol in the form of boilermakers. For most people, however, we might expect beer, wine, and liquor to be substitutes, meaning that a reduction in the price of any one of these three would increase the demand for the other two.

- (3)

-

Economists usually express the responsiveness of demand to prices and income in terms of elasticities. For example, the "own price elasticity of demand" is defined as the percentage change in quantity demanded resulting from a 1-percent change in own price. The "income elasticity of demand" is defined analogously.

If the own price elasticity is between zero and minus one, demand is inelastic; if less than minus one, it is elastic. It can be demonstrated mathematically that if the demand for a commodity is inelastic, then an increase in its price will result in an increase in expenditure on that commodity; if demand is elastic, expenditure will fall in response to price increase.

The Econometric Approach to Estimating Price and Income Effects

In practice, estimates of price and income effects for alcoholic beverages have been based on aggregate data rather than data on individual consumption decisions with respect to individual brands of alcoholic beverages:

- (1)

-

Adequate data on consumption and income are usually not available for individuals or households. Most demand estimates have been based on data for average consumption, income, and price levels for the entire populations of geographic units—states, provinces, or even entire countries.

- (2)

-

Most studies have aggregated the scores of varieties of alcoholic beverage into three categories: liquor, wine, and beer. Quantity is measured by volume of liquid within each category and price as some sort of average or index of the prices of all the brands included in the category. This type of aggregation conceals interbrand substitution that may result from price changes. For example, an increase in the average price of liquor may induce consumers to substitute cheaper for more expensive brands, thereby perhaps maintaining their volume of liquor consumption despite the general increase in prices.

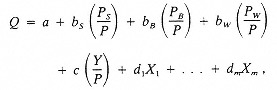

Equation (1) is too general (in a mathematical sense) to be estimated. In practice, the demand function that has been estimated has a form similar to the following:

(2)

where

View in own window

| Q | = per-capita consumption of spirits (or beer or wine), |

| P S, PB, PW | = prices of spirts, beer, and wine, respectively, |

| Y | = per-capita disposable income, |

| P | = consumer price index, |

| X 1, … , X m | = other variables thought to influence consumption. |

Some studies have used the logarithm of these variables instead of estimating the linear form of the equation. Other mathematical transformations are also possible. The "correct" mathematical form is not known; any particular form chosen by the econometrician is at best an approximation of the correct form.

Given the appropriate data, it is possible to estimate the parameters of (2) using standard econometric techniques (e.g., regression analysis). The resulting estimates for b S, bB, and b W measure the effect of these prices on quantity demanded. In a demand equation for spirits, we would expect b S to be negative, b W and b B to be positive (assuming they are substitutes for spirits), and c to be positive (assuming spirits is a normal commodity). The econometric estimates of these parameters serve as a test of these qualitative hypotheses. These estimates are never precise; the regression analysis provides a basis for calculating the range of statistically reasonable values for each parameter (confidence intervals).

There are a variety of statistical problems encountered in attempting to develop reliable estimates of price and income effects. These problems are introduced and discussed in the course of the literature review below.

Results from Econometric Studies

Of all published econometric studies of alcoholic beverage demand using data for the United States or Canada, the most noteworthy is by Johnson and Oksanen (1977). They estimated separate demand equations for beer, wine, and spirits, using panel data for 10 Canadian provinces for 15 years (1956–1970). Each of their demand equations includes the following independent variables: prices for beer, wine, and spirits relative to the consumer price index; real income per adult; the dependent variable (consumption) lagged 1 year; and variables representing ethnicity, schooling, religion, and strikes affecting alcoholic beverage sales. Several estimation techniques were used. Since they yielded virtually identical results, I will limit my discussion to one of these techniques: ordinary least squares with separate dummy variables for each province. The following points should be taken into account in considering their results:

- (1)

-

The authors assume that prices are exogenous, because "In the Canadian institutional setting, prices are established by government agencies" (p. 114). The possibility that the price policies of government agencies may be influenced by demand conditions is not considered.4

- (2)

-

The authors avoid the problem of developing a statistical explanation for the large cross-sectional (interprovince) differences in consumption because of the nature of their data. All equations are estimated in first difference form, which of course is impossible when only cross-sectional data for 1 year are available.5 This is important because the large cross-sectional differences in consumption levels are probably more a reflection of cultural differences than of differences in prices and income (Simon 1966). The use of the first difference form reduces the importance of finding adequate empirical proxies for these cultural differences. The same point applies to the problem of cross-sectional differences in nonprice regulations of beverage sales. Of course, to the extent that "culture" and nonprice regulations change over time, it is still necessary to control for them. But these intertemporal changes are likely to be small relative to cross-sectional differences, at least for the 15-year period under consideration here.

- (3)

-

The authors' specification includes dummy variables for each province. These variables are meant to capture province-specific trends in the underlying determinants of consumption behavior not otherwise specifically accounted for in the demand equation.

- (4)

-

The inclusion of all three prices in each demand equation permits estimation of the cross-price effects on demand, as well as the own price effect.

- (5)

-

The inclusion of lagged consumption in the specification is justified by the possibility that alcohol consumption behavior exhibits some degree of habit formation, and hence the full, long-run response to a change in price or income does not emerge immediately. Including this variable creates certain econometric problems, which are discussed by the authors.

The key results of this analysis are summarized in Table 2. The shortrun demand for spirits is elastic with respect to own price, but beer and wine are inelastic. Income changes have little or no effect on demand. The cross-price effects (not shown in this table) tend to be small. These estimated effects suggest that spirits and beer are complements, whereas wine and beer are substitutes—but the evidence from the Johnson-Oksanen study is not very strong on this issue.

TABLE 2

Estimated Elasticities for Spirits Demand in Canada.

There have been no published studies using U.S. data that are comparable in scope and quality to that of Johnson and Oksanen. A major limitation on studying U.S. alcoholic beverage demands is the lack of state-level price data for beer and wine. One exception is Hogarty and Elzinga (1972), who were able to obtain data on beer prices for two brands; these data were entered into the public record as a result of an antitrust suit by the U.S. Department of Justice. They used these annual state-level data for the period 1956–1959 to estimate the following equation:

(3)

where

View in own window

| B | = beer consumption per adult, |

| P B | = price of beer, |

| F | = percent foreign born, |

| Y | = per-capita income. |

Their results imply a price elasticity of -0.9 and an income elasticity of 0.4. They also experimented with including a spirits price variable in their equation but rejected it because the result implied that beer and spirits are complements—a result that they thought highly unlikely. This study makes no special use of the panel structure of the data, and the specification is highly inadequate to the task of controlling for non-economic influences on beer consumption.

Price elasticities of spirits consumption estimated from U.S. state-level data have been questioned because of problems with official data on liquor sales. These data are based on reports by wholesalers to the tax authorities and differ from actual liquor consumption by state residents in three potentially important respects: (1) "moonshine" liquor is of course not included; (2) wholesalers may underreport their sales in order to evade state taxes; and (3) some consumers may "import" their liquor from an adjacent state if price differences between the two states make this activity worthwhile.

If a state raises its tax on liquor, the resulting reduction in reported sales may thus exaggerate the true reduction in consumption by state residents due to either an increase in moonshining, an increased propensity of wholesalers to conceal sales from tax authorities, or increased purchases in adjacent states (the "border effect"). These problems may also be present for beer and wine sales, of course.

Two empirical studies (Waler 1968 and Smith 1976) have attempted to estimate the magnitude of the "border effect" in spirits commerce. Waler (1968) reports on the basis of his analysis of 1960 cross-sectional data for 42 states that "… the price coefficient becomes negligible and insignificant when interstate effects are included, suggesting that the large and significant price coefficient obtained in the misspecified model is completely spurious" (p. 858). Waler's method for taking account of border effects is complex and problematical, and his specification of the demand equation is highly inadequate (his only explanatory variables are price and income). His conclusion therefore is in doubt.

Smith (1976) estimates his liquor demand equation from 1970 cross-sectional data on 46 states. One of his variables is the price of liquor in the adjacent state with the lowest price—a variable that he believes should "control for" the border effect. This interpretation is dubious, since relative prices in all adjacent states are relevant to determining the net magnitude of the border effect for any one state.6

Smith also attempts to allow for underreporting of liquor sales by wholesalers. He finds that the tax elasticity of demand is larger than the elasticity with respect to net price (price net of tax) and interprets this difference in elasticities as an indication that an increase in the state tax increases the propensity of wholesalers to underreport. These results are critiqued by Hause (1976), and it is clear that Smith's interpretation is tenuous. In any case, Smith's specification is highly simplistic—he, like Waler, makes no attempt to control for interstate differences in culture, ethnicity, religion, or nonprice regulations on alcohol sales and consumption. We are left without reliable estimates of the importance of the border effect, underreporting by wholesalers, and other difficulties with state data.

There have been several econometric studies of the demand functions for alcoholic beverages based on aggregate time series data for the United States. Niskanen (1962), for example, estimated both demand and supply functions for spirits, beer, and wine, using observations of 22 years (1934–1941 and 1947–1960). The use of U.S. aggregate data eliminates the border effect as a concern. A major problem is that the small number of observations necessitates use of very simple specifications; the list of explanatory variables in Niskanen's demand equations is limited to prices and two measures of consumer purchasing power. Presumably, there were other factors having an important influence on drinking patterns that changed between 1934 and 1960: Niskanen's omission of these other factors (whatever they might be) almost certainly causes his estimates of price elasticities to be biased. Nonetheless, these estimates are widely cited—in part because they are dramatically large. He found the demand for spirits to be highly price elastic (-2.0), while beer was -0.6 and wine around -0.7. Another econometric analysis of spirits consumption based on time series data for the United States, by Houthakker and Taylor (1966), is cited for the opposite reason: their estimate of price elasticity was slightly positive, though not significantly different from zero in a statistical sense.

My conclusion from reviewing econometric studies of alcoholic beverages is that there are no reliable estimates for the price elasticities of demand based on U.S. data.7 Recent studies, summarized above, should serve to sensitize researchers to some of the econometric estimation problems that are peculiar to this class of commodities.

Quasi-Experimental Analysis of the Demand for Liquor

The econometric approach to estimating the price elasticity of demand for alcoholic beverages has dominated this empirical literature, but it is not the only available estimation technique. Julian Simon (1966) introduced a "quasi-experimental" approach and argued persuasively that it offers a basis for more reliable estimates than regression analysis of cross-sectional or time series data.

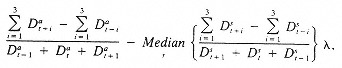

Simon analyzed 23 cases in which the price of liquor increased by more than 2 percent from one year to the next in a state. Apparently he limited his study to cases in which such a price change was induced by an increase in the state liquor tax. For each such case, he calculated the apparent price elasticity of demand, using the following procedure:

- (1)

-

Calculate the following formula as a measure of the proportional change in the state per-capita liquor consumption resulting from the price increase:

where

and so forth. The "before" and "after" periods are each 12 months long, chosen so as to leave a 7-month gap around the month of the price change. Simon used two groups of "comparison states": if the price change was in a monopoly state, then the group of comparison states consisted of all other monopoly states except those that had a contemporaneous price change; if the price change was in a license state, then the group of control states consisted of all other license states except those with a contemporaneous price change. Simon experimented with several methods for averaging consumption changes across control states.

- (2)

-

The number calculated from the above formula was divided by the percentage change in price; the resulting ratio is then an estimate of the price elasticity of liquor demand.

- (3)

-

The median of the 23 estimates of price elasticity thus derived was Simon's choice for a point estimate of the price elasticity. His median was -0.79.

(4)

View in own window

| | = per-capita liquor consumption in state a (the "trial" state) for a 12-month period beginning 3 months after the tax change; |

| | = comparison states' per-capita consumption during a 12-month period beginning 3 months after the tax change; |

Simon's method shares some of the problems discussed above in reference to the econometric studies. In particular, he makes no attempt to control for the border effect or for possible changes in the accuracy of reporting of sales by wholesalers. (He does take the moonshining problem into account by excluding states with a high incidence of moonshining from his analysis.) It is possible, then, that his elasticity estimates are biased.

There are two great virtues of Simon's technique: first, since the price changes he studies are induced by changes in the tax rate, it is reasonable to suppose that these changes are truly exogenous to the market and not induced by changes in demand. The "causal ordering" problem is thus circumvented—unless it can be argued that state legislatures and regulatory agencies take market conditions into account when setting the tax rate. Second, Simon's method for controlling for nonprice influences on liquor demand—his use of control states—is probably more reliable than the econometric technique of specifying one or more variables in the regression equation to reflect and control for these influences. It is not clear that these influences are adequately measured by any short list of socioeconomic variables. Simon's technique is justified by the presumption that nonprice factors that influence consumption in one state in any given year will also be influential in other states in that year. As long as the sample of trial states is representative of the United States as a whole, then Simon's approach yields an unbiased estimate.

Simon's price elasticity estimate of -0.79 seems reasonable. Since he has only 23 observations, and these observations have a rather high variance, his point estimate is not precise. He reports that "We may say with 0.965 probability that the mean of the population from which this sample of elasticity estimates was drawn is between -0.03 and -0.097" (p. 198).

A Replication

I have replicated Simon's study using state tax changes occurring between 1960 and 1975. I have limited this study to license states and excluded states in which the tax change was less than $0.25 per gallon. Alaska, Hawaii, and the District of Columbia were also excluded. The resulting sample contains 39 observations.

The formula I used to calculate the proportional change in liquor consumption induced by these tax changes differs in a number of minor respects from that used by Simon: (1) The "before" and "after" comparison is based on the calendar years preceding and following the year of the tax change without regard to the month in which the change occurred. This approach simplifies computations considerably. (2) Instead of using some sort of average of proportional changes in consumption for some group of states as a control, I have in all cases used the median proportional change in consumption for the year in question as a basis of comparison. The median is calculated from the 30 license states (of the 48 contiguous states) in each year. Experiments with other approaches to choosing a basis of comparison (e.g., using the median of the entire list of 48 states in each year, or the proportional change in total U.S. consumption as the basis for comparison), demonstrated that this choice makes little difference to the results.

The formula I used can be written as follows:

(5)

where

View in own window

| | = total liquor consumption divided by the population aged 21 and over in year t and state a (the state incurring the tax change). |

My results are reported in Table 3. Of the 39 observations, 30 of the net consumption changes,  , calculated from this formula were negative. This is very strong evidence that an increase in tax reduces reported liquor sales in a state, other things being equal. One test of the statistical significance of this result is the following: The null hypothesis is that price has no effect on consumption. Under this assumption, the probability of obtaining 30 or more negative changes out of 39 trials is less than one-tenth of a percent. This nonparametric "sign" test is a strong indication that the null hypothesis should be rejected in favor of the alternative that an increase in price reduces consumption.

, calculated from this formula were negative. This is very strong evidence that an increase in tax reduces reported liquor sales in a state, other things being equal. One test of the statistical significance of this result is the following: The null hypothesis is that price has no effect on consumption. Under this assumption, the probability of obtaining 30 or more negative changes out of 39 trials is less than one-tenth of a percent. This nonparametric "sign" test is a strong indication that the null hypothesis should be rejected in favor of the alternative that an increase in price reduces consumption.

TABLE 3

Effects of Changes in State Liquor Tax Rates.

An estimate of the apparent price elasticity of demand can be developed by converting each of the statistics in Table 3 ("net change in liquor consumption") by the proportionate change in price caused by the tax change for each observation. To calculate the proportionate change in price, I multiplied the tax increase by 1.2 (i.e., I assumed a 20-percent markup on tax) and divided by the average retail price of liquor for the appropriate state and year.8 The median of the resulting price elasticity estimates for the 39 observations was -1.6. This result implies that a 10-percent increase in the price of spirits in a state results in a 16-percent reduction in quantity purchased in that state. This is of course a point estimate, which is subject to statistical error. Given the distribution of the 39 elasticity estimates, it can be shown that there is a 95-percent chance that the true elasticity is less than -1.0 (i.e., that the demand is elastic with respect to price).

My point estimate of -1.6 is considerably larger than Simon's estimate of -0.8. The difference may be partly the result of Simon's using a larger assumed markup. He is not precise about what rate of markup he used, merely noting that it was the "customary retail" rate (which is surely higher than 20 percent). If I had assumed an 80-percent markup, for example, my elasticity estimate would have been reduced to -1.07. However, as explained in the preceding footnote, a 20-percent markup appears to be the appropriate assumption for the retail liquor industry.

It should be noted that the interpretation of the resulting elasticity estimate is complicated by the fact that in 16 of the 39 instances in which states increased the liquor tax, there was a contemporaneous increase in the state tax on beer. If beer is a substitute for liquor, then the effect of these contemporaneous changes will be to bias the liquor price elasticity upward. For this reason, the estimated price elasticity of demand for liquor may understate the true price elasticity.

For the procedure outlined above to give a valid, unbiased measure of the effect of tax changes on liquor sales, it is necessary that state tax changes not be systematically related to historical trends in consumption in the state. It is possible that the decisions of state legislatures to change liquor taxes are systematically related to trends in state sales (or tax revenue collections). Suppose arguendo that legislatures tend to raise taxes in response to an unsatisfactorily slow growth in liquor tax revenues. Then states that raise their taxes will be a biased "sample" of all states, the bias being in the direction of relatively slow growth in consumption. The statistical procedure reported above would then yield misleading results; the bias in the measure of price elasticity would be negative, yielding an exaggerated notion of the degree to which reported consumption was responsive to price. To test for this and related possibilities and more generally to test whether the state with tax changes can reasonably be viewed as a representative sample of all states, I calculated the net proportional growth rate in liquor consumption (the same measure as reported in Table 3) for all states that had tax changes during the sample period, but for a period that preceded the year of the tax change by 2 years. Consistent with the notation defined in formula (5) above, this statistic is denoted  . If tax changes occur "at random" among states and are not influenced by recent history in liquor consumption, then we would expect that it would equally be likely for any one of these values to be positive or negative. The results are consistent with these predictions: 21 of 36 states (58 percent) for which it was possible to do this calculation9 had negative values, while 15 were positive. The probability that this difference would occur by chance alone is 40 percent. These results are compatible with the claim that tax changes are exogenous events with respect to consumption trends and that the states with tax changes are representative of all states during the sample period.

. If tax changes occur "at random" among states and are not influenced by recent history in liquor consumption, then we would expect that it would equally be likely for any one of these values to be positive or negative. The results are consistent with these predictions: 21 of 36 states (58 percent) for which it was possible to do this calculation9 had negative values, while 15 were positive. The probability that this difference would occur by chance alone is 40 percent. These results are compatible with the claim that tax changes are exogenous events with respect to consumption trends and that the states with tax changes are representative of all states during the sample period.

The Effect of Tax Increases on Auto and Cirrhosis Fatalities

Introduction

The association between drinking and excess mortality from a variety of causes has been thoroughly documented. Excess drinking has been particularly strongly implicated as a major causal factor in auto accidents and cirrhosis of the liver. If an increase in the price of liquor reduces average consumption, it is reasonable to suppose that an increase in the liquor tax rate may reduce the mortality rate due to these causes. Nevertheless, there are a number of reasonable doubts about this conjecture, which are summarized here in three questions.

While the evidence presented in the previous section convincingly demonstrates that an increase in the liquor tax rate reduces reported liquor sales, the effect on actual consumption of liquor may be smaller or nonexistent: the differences between reported sales and actual consumption, as discussed above, are the result of moonshining, underreporting by wholesalers, and the "border effect." Is average liquor consumption responsive to changes in the price of liquor?

Even if actual consumption of liquor is reduced as a result of tax (price) increases, consumers may maintain their average level of alcohol consumption by substituting beer or wine for liquor. (Liquor only accounts for about 40 percent of beverage alcohol consumed in the United States.) Is average alcohol consumption responsive to changes in the price of liquor?

Even if an increase in the price of liquor does reduce total alcohol consumption, this reduction will have no effect on cirrhosis and auto fatalities if it is limited to moderate drinkers. Studies of price effects on average alcohol consumption give no indication of the distribution of these effects among different types of drinkers. Is average alcohol consumption of heavy drinkers responsive to changes in the price of liquor?

There is no need to respond to these questions directly. The quasi-experimental method of measuring the price elasticity of liquor consumption, developed in the previous section, can also be used to measure the effect of tax increases on cirrhosis and auto accident fatality rates. The resulting estimates can virtually speak for themselves. If changes in liquor prices have the expected effect, it will be revealed by this method, and we can then draw the appropriate conclusions about the three questions. I report my results after a discussion of the literature on cirrhosis. No discussion of the relationship between drinking and auto fatalities is presented, since David Reed's paper in this volume has a thorough discussion of this issue.

Cirrhosis and Drinking

Cirrhosis is a disease of the liver in which the capacity of the liver to cleanse the blood and perform its other functions is reduced due to scarring of the liver tissue. Most people who die of cirrhosis have a long history of heavy drinking.10 The liver is capable of processing a moderate level of alcohol intake without sustaining any damage. The cirrhosis disease process reflects a repeated "overload" of alcohol in the system.11 If the cirrhosis victim reduces consumption, then the scarring process will be slowed or stopped and his or her life will ordinarily be prolonged.

Cirrhosis Mortality Rates as an Indicator of Heavy Drinking

A number of researchers have suggested that the cirrhosis mortality rate for a population is a good indicator of the fraction of the population that is drinking "heavily" (Skog, forthcoming). As such, the cirrhosis mortality rate can be used to compare relative incidence of heavy drinking in different populations or to measure trends in the incidence of heavy drinking for a single population. The main difficulty with using cirrhosis mortality in this fashion is that the current cirrhosis mortality rate reflects not only the current incidence of heavy drinking, but also the trend in heavy drinking during the preceding 15–20 years (Jellinek 1947); a change in drinking habits in a population will not be fully reflected in cirrhosis mortality for this period of time. However, the short-run response of cirrhosis to heavy drinking is not necessarily negligible. We can imagine a population to have a "reservoir" of cirrhosis victims whose disease has progressed to a greater or lesser extent (Schmidt and Popham, forthcoming); if this group changes its drinking patterns, there will be some effect on the cirrhosis mortality rate within a short time.

To the extent that cirrhosis mortality rates do serve as an indicator of the incidence of heavy drinking, they are of considerable value in alcohol research. A number of social and medical problems besides cirrhosis are related to heavy drinking.12 If it can be demonstrated that a particular alcohol-related policy is effective in reducing cirrhosis, then it would be expected that this intervention is also having the effect of reducing other problems associated with heavy drinking.

Previous Studies Relating Price to Cirrhosis Deaths

Seeley (1960) calculated intertemporal correlations between an alcohol price variable and the cirrhosis death rate for Ontario and for Canada, using annual data for 1935–1956. His "price" variable was an index representing the price of a gallon of beverage alcohol, divided by average disposable income. His work was extended to other countries and time periods by Popham et al. (1976). The reported correlations are typically close to 1.0. The authors' intepretation of these findings is that consumption levels by heavy, cirrhosis-prone drinkers are responsive to price.

There are two main problems with these studies. First, the "price" variable confounds the price of alcohol with income. The studies reviewed in the section above on demand for alcoholic beverages have consistently found that average consumption responds differently to changes in income and changes in price. Johnson and Oksanen (1977) in particular found that drinking in Canada was highly responsive to price but unresponsive to income. The second problem is that these correlation results may well be the result of "third-cause" variables, not included in the analysis, that are responsible for trends in both price and in the incidence of heavy drinking.

Historical "experiments" with large changes in price and conditions of availability provide another source of evidence on the degree to which heavy drinkers are responsive to such environmental factors. Prohibition is an obvious case in point. Warburton (1932, p. 240) found that alcoholic beverage prices during Prohibition were three to four times higher than before World War I. Cirrhosis death rates reached their lowest level of the 20th century shortly after World War I and remained constant at this low level (7–8 per 100,000) throughout the 1920s (p. 213). Furthermore, the drop in cirrhosis death rates was apparently greater for the relatively poor than for others, a result that reinforces the notion that high prices were at least in part responsible for the reduction in the prevalence of heavy drinking during this era:13 Warburton (p. 239) reports that the cirrhosis death rate for industrial wage earners fell further than for city residents as a whole. Terris (1967, p. 2077) reports that the age-adjusted cirrhosis death rates dropped further for blacks than for whites between 1915 and 1920 and that these rates preserved their new relative position through the 1920s.14

Conclusions

Most cirrhosis deaths are the result of many years of heavy drinking. Cirrhosis is to some extent an "interruptable" disease process, so that a reduction in consumption on the part of a cirrhosis victim, even one whose condition is quite advanced, will extend life expectancy. The cirrhosis death rate may be a reasonably good indicator of the incidence of heavy drinking in a population. Previous research has provided some evidence to the effect that an increase in the price of alcohol will reduce the incidence of heavy drinking and the cirrhosis death rate, although this evidence is by no means decisive or compelling.

Results of a Quasi-Experimental Study

The nature of and justification for the quasi-experimental approach to studying the price elasticity of demand for liquor was explained above in the section on demand for alcoholic beverages. The same approach is used here to measure the short-term effect of changes in the liquor tax on the death rate due to cirrhosis and auto accidents.15 This study uses the same 39 observations as the consumption study with one exception: data did not permit inclusion of the 1975 tax change in Massachusetts.

The results are reported in Tables 3 and 4. The formula used to calculate the "net change in auto fatalities" is strictly analogous to the formula used in the consumption study, with the auto fatality rate replacing liquor consumption per capita. The formula used to calculate the "net change in the cirrhosis death rate" is a bit more complicated. It can be written as follows:

TABLE 4

Analysis of Tax-Related Changes.

(6)

where and so forth. This formula permits delayed effects of the tax change on cirrhosis to be taken into account.

View in own window

| | = the cirrhosis death rate in the "trial" state i years after the tax change, |

The results of this analysis are summarized in Table 4. About 66 percent of the "net change" observations in the case of auto fatalities were negative. If tax changes in fact had no effect on auto fatalities, we would expect that only about 50 percent of these observations would be negative. The probability that 66 percent or more would be negative given the null hypothesis of "no effect" is less than 4 percent. Therefore, we can conclude with considerable confidence that a liquor tax increase tends to reduce the auto fatality rate.

About 63 percent of the "net change" observations in the case of cirrhosis deaths were negative. The probability of this high a fraction of negative values by chance alone is about 7 percent. It appears likely, then, that increases in liquor tax reduce the cirrhosis death rate.

As in any statistical study, these findings do not offer definitive proof of anything. However, the preponderance of the evidence certainly supports the conjecture that the price of liquor is one determinant of the auto accident and cirrhosis death rates. The quasi-experimental technique employed here minimizes problems of interpretation and in particular minimizes doubts concerning the causal process that underlies the results.

I conclude, then, that despite the questions posed at the beginning of this section, there is good reason to believe that the incidence of heavy drinking responds to liquor price changes of relatively small magnitude. The magnitudes of these responses are highly uncertain but can be estimated using the same techniques as were employed in estimating the price elasticity of demand. I converted the "net change in auto fatality rate" and the "net change in cirrhosis death rate" statistics (from Table 3) into price elasticities. The median of these price elasticities is -0.7 for auto fatalities and -0.9 for cirrhosis deaths. It seems entirely reasonable that these elasticity estimates turn out to be less than the price elasticity of demand for distilled spirits.

Evaluating Alcoholic Beverage Taxation

Alcoholic beverage prices have a direct effect on the prevalence of chronic excess consumption and the prevalence of the various problems caused by chronic excess consumption. There are three sources of evidence for this conclusion: (1) numerous studies, including my own (see the section on demand for alcoholic beverages), have found that per-capita consumption of alcoholic beverages is responsive to price changes. It is possible but unlikely that this observed responsiveness of aggregate drinking to price is due entirely to light and moderate drinkers;16 (2) large changes in price associated with the adoption of Prohibition and other "natural experiments" of this sort have been associated with large reductions in the cirrhosis mortality rate and other indicators of the prevalence of excess consumption; and (3) small increases in the tax rate for spirits appears to reduce cirrhosis and auto fatality rates.

Each of these pieces of evidence is subject to legitimate scientific doubt. Nonetheless, I believe that, taken together, they provide a strong case for the proposition that an increase in the price of alcoholic beverages will reduce the prevalence of excess consumption and the incidence of the various problems caused by chronic excess consumption. The magnitude of the effect that could be generated by, say, a 20-percent increase in the alcoholic beverage price level is highly uncertain, although it appears likely that the effect of such an increase would be measured in terms of thousands of lives saved per year and billions of dollars of savings in medical and related expenses. Since the prices of alcoholic beverages are currently and historically controlled to a considerable extent by government policy, it is appropriate to view alcoholic beverage prices as public health policy instruments. This conclusion is empirical, rather than normative—it is by no means equivalent to concluding, for example, that it would be a good thing to raise the federal excise tax on alcohol or that higher prices are better than lower prices. A complete evaluation of a change in alcohol price policy requires consideration of other effects in addition to those related to public health. In particular, the distributive effects of a tax-induced increase in price should be considered, as should the loss in consumer benefits associated with low alcoholic beverage prices. These two types of concerns are discussed below.

Incidence

The distribution of alcohol consumption levels among individuals is very diffuse and skewed to the right. This characterization is valid for every population group that has been studied (Bruun et al. 1975). Roughly speaking, one-third of U.S. adults abstain, one-third drink very lightly (up to three drinks per week), and the remaining third account for most of the total consumption.17 More precise characterizations of drinking distributions can be calculated from two recent studies. The Rand survey of drinking practices in the U.S. Air Force (Polich and Orvis 1979) found that 10 percent of the surveyed population (including abstainers) consumes 51 percent of the alcohol; 10 percent of the drinking population consumes 47 percent of the total alcohol.18 DeLint and Schmidt's (1968) study of bottle purchases from government stores in Ontario found that 10 percent of consumers purchased 42 percent of the total alcohol.19 Because the distribution of consumption has this property of concentrating a high percentage of consumption among a relatively few people, the incidence of alcohol taxation is necessarily very unequal. Whether this degree of inequality is good or bad depends on one's perspective. Three questions, reflecting three rather different normative perspectives on the incidence issue, are posed and discussed below.

How is the incidence of alcohol taxation related to the consumer's ability to pay?

Almost $10 billion in direct taxes and fees on alcoholic beverages was collected by all levels of government in 1976 (DISCUS 1977a). In most jurisdictions this revenue was not earmarked for specific programs but rather is used to help finance a wide range of governmental activities. One traditional standard in the public finance literature is that such general public revenues should be collected on an "ability to pay basis"; households with equal incomes should make equal contributions, and tax contribution should increase with income. By this principle, taxes on alcoholic beverages clearly receive low marks. Households with equal incomes pay vastly disparate alcohol taxes, depending on their alcohol consumption levels.

How much of a burden does alcohol taxation impose on members of poor households?

The answer to this question is not known, but it is useful to outline the relevant issues. First, an increase in alcohol taxes is disadvantageous for adult individuals and household heads who drink; they would not voluntarily choose to pay higher prices. Their dependents may be made better off, however, depending on the response of the household's drinking members to the price change. An increase in the taxes on alcoholic beverages can either increase or reduce the total expenditures of poor households on alcohol, thereby leaving more or less money for food, clothing, and shelter. For households whose demand for alcoholic beverages is elastic (price elasticity less than -1.0), an increase in price will cause a reduction in total expenditure on drinking, while expenditures will increase for other households. Surely poor households differ considerably among themselves with respect to price elasticity of demand. However, the evidence above suggests that the average household's demand for spirits, at least, is quite elastic; furthermore, poor households would tend to be more elastic than higher income households. Therefore, for a high but unknown percentage of poor households, an increase in alcohol taxation should reduce expenditures for alcoholic beverages. Furthermore, it is quite possible that a tax-induced reduction in drinking in households that are at the high end of the drinking distribution may lead to reduced medical expenditures and increased earnings from employment.

Is the incidence of alcoholic beverage taxation related to the benefits received from government?

An alternative to the "ability to pay" standard is the "benefits" standard, which states that the distribution of tax liability should be closely related to the distribution of benefits received from government programs. To a large extent medical care, alcoholism treatment, minimum income maintenance, and other social services are provided and financed by government. The various health and social problems associated with alcohol consumption place expensive demands on these services. These problems are highly concentrated among the same group that pays the bulk of alcohol taxes—the chronic excess consumers. It is clear, then, that there is fairly close positive association between the amount of an individual's alcohol tax contribution and the expected value of government services consumed by the individual for alcohol-related problems. We view alcohol taxes as analogous to insurance premiums that are calibrated to one determinant of risk—the average rate of alcohol consumption—just as health and life insurance premiums are adjusted for age.

We could label this view of the alcohol tax the "drinker should pay" standard. This standard suggests that it is appropriate to set alcohol taxes at a level such that tax revenues are equal to the total government-financed costs of alcohol-related problems. Or we could choose to go further, by the same justification, and structure taxes so that drinkers collectively pay the total bill for the alcohol-related externalities, including private costs borne by other individuals (e.g., we all pay higher premiums for private health and life insurance policies because some insured people drink unhealthy or unsafe amounts). Aside from the problem of actually calculating the social costs of drinking, these quantitative standards are vulnerable to a major objection: the social harm of drinking is not proportional to the rate at which an individual consumes alcohol, so that a tax that is proportional to consumption will not be strictly proportional to alcohol-related harms. Figure 2 illustrates a hypothetical relationship that depicts average social cost increasing with consumption. The relationship is not strictly proportional because it incorporates two reasonable assumptions: (1) average social cost increases disproportionately with consumption; and (2) individuals at the same consumption level differ widely with respect to the external harm caused by their drinking, due perhaps to differences in personality, metabolism, drinking patterns, and so on. A tax that is proportional to the ethanol content of alcoholic beverages will then result in light drinkers, and the "safer" heavy drinkers, paying more than "their share" of the total bill for alcoholic-related social costs. Whether this arrangement is deemed better or worse than paying these costs from general tax revenues is a matter of preference. In my judgment, the "drinker should pay" principle is not sufficiently compelling in itself to justify high taxes on alcoholic beverages. But it should be kept in mind that high taxes reduce the social costs of drinking in addition to providing a mechanism for financing these costs.

Figure 2

Hypothetical relationship between individual's consumption and resulting social harm.

Cost-Benefit Analysis

Besides providing a source of government revenue, taxes on alcohol influence the volume of total sales and the distribution of that volume among individual drinkers. If alcohol were not taxed, the price of alcoholic beverages would be too low because it would not reflect the negative externalities of drinking. The Pigovian principle requires that the tax on an externality-generating activity be set equal to the difference between the marginal social cost of the activity and its marginal private cost—an approach long advocated by economists for controlling environmental pollution. The objective of this type of tax is to "internalize" the external costs of the activity, thereby giving agents the incentive to curtail the activity in question to the appropriate level (i.e., the level at which every unit of the activity is valued at least as highly as the true social cost of that unit of activity). The normative force of this principle is undermined in the case of drinking by the fact (illustrated above in Figure 2) that the social cost of a drink differs depending on who consumes it and under what circumstances. Therefore, an increase in the tax on alcoholic beverages will deter some drinking that is socially worthwhile (the value to the consumer exceeds the social cost) as well as some that is not worthwhile. Given this situation and ignoring the distributional issues discussed above, the appropriate tax rate should be chosen by comparing costs and benefits at each tax level.

The marginal social benefit of a tax increase is equal to the value of the reduction in negative externalities that will result from reduced consumption, plus the additional tax revenue obtained. The marginal social cost of a tax increase is equal to the value of "consumers' surplus"20 lost as a result of the tax. In principle, the tax rate is "too low" if the additional benefit of an increase exceeds the loss in consumers' surplus. It should be clear that it is very difficult to implement this principle due to the considerable uncertainty about the actual magnitudes of these theoretical constructs. But this discussion will perhaps serve as a useful framework for further empirical research in this area.

Conclusion

Public enthusiasm for government restrictions on drinking peaked in the early years of this century when many states and eventually the nation adopted Prohibition. Since the repeal of Prohibition in 1933 there has been a more or less steady decline in government restrictions on availability. Perhaps the most important aspect of this trend in recent years has been the rather sharp decline in the prices of alcoholic beverages (relative to average prices of other commodities) caused in large part by the failure to increase taxes commensurate with the inflation rate. While the public remains concerned about the "alcohol problem," there is a widespread belief that restricting availability is not an effective strategy for combating this problem. For example, a recent study by Medicine in the Public Interest (1979) concluded that state legislators are "generally skeptical about the effect of regulations, including taxation, on the incidence, patterns, or circumstances of use" (p. 31). On the basis of the evidence reported above, it appears quite likely that the legislators' view is incorrect—taxes do reduce total consumption and in particular reduce those portions of total consumption associated with auto fatalities and liver cirrhosis. If correct, these findings suggest that legislators should view alcohol taxation as a policy instrument for combating alcohol-related problems and not just a source of revenue. I am not advocating that taxes be raised—there are costs as well as benefits to raising taxes and the evidence presented above is far short of a complete cost-benefit analysis of a tax change. Rather the message of my results is that the benefits do exist and should be taken into account.

References

-

Bruun, K., Edwards, G., Lumio, M., Mäkelä, K., Pan, L., Popham, R. E., Room, R., Schmidt, W., Skog, O.-J., Sulkunen, P., and Österberg, E. (1975) Alcohol Control Policies in Public Health Perspective . The Finnish Foundation for Alcohol Studies, Vol. 25. Finland: Aurasen Kirjapaino, Forssa.

-

Bureau of the Census (1971) Population estimates and projections. Current Population Reports , Series P-25, No. 460. Washington, D.C.: U.S. Department of Commerce.

-

Bureau of the Census (1978) Population estimates and projections. Current Population Reports , Series P-25, No. 727. Washington, D.C.: U.S. Department of Commerce.

-

deLint, J., and Schmidt, W. (1968) The distribution of alcohol consumption in Ontario. Quarterly Journal of Studies on Alcohol 29(4):968–973. [PubMed: 5705418]

-

DISCUS (1977. a) DISCUS 1977 Tax Briefs . Washington, D.C.: Distilled Spirits Council of the United States, Inc.

-

DISCUS (1977. b) Summary of State Laws and Regulations Relating to Distilled Spirits , 22nd ed. Washington, D.C.: Distilled Spirits Council of the United States, Inc.

-

DISCUS Facts Book (1977) Beverage Alcohol Industry: Social Attitudes and Economic Development . Washington, D.C.: Distilled Spirits Council of the United States, Inc.

-

Gavin-Jobsen Associates, Inc. (1978) The Liquor Handbook . New York: Gavin-Jobsen Associates, Inc.

-

Hause, J. C. (1976) Comment. Journal of Law and Economics 19(2):431–435.

-

Hogarty, T., and Elzinga, K. (1972) The demand for beer. Review of Economics and Statistics 54(May):195–198.

-

Houthakker, H. S., and Taylor, L. D. (1966) Consumer Demand in the United States, 1929–1970 . Cambridge, Mass.: Harvard University Press.

-

Jellinek, E. M. (1947) Recent trends in alcoholism and in alcohol consumption. Quarterly Journal of Studies on Alcohol 8:1–42. [PubMed: 20242600]

-

Johnson, J. A., and Oksanen, E. H. (1977) Estimation of demand for alcoholic beverages in Canada from pooled time series and cross sections. Review of Economics and Statistics 59(1):113–118.

-

Lau, H-H. (1975) Cost of alcoholic beverages as a determinant of alcohol consumption. In R. J. Gibbins, editor. et al., eds., Research Advances in Alcohol and Drug Problems , Vol. II. New York: John Wiley & Sons.

-

Medicine in the Public Interest, Inc. (1979) The Effects of Alcohol-Beverage Control Laws . Washington, D.C.: Medicine in the Public Interest, Inc.

-

National Institute of Alcohol Abuse and Alcoholism (1978) Third Special Report to the U.S. Congress on Alcohol and Health . Washington, D.C.: U.S. Department of Health, Education, and Welfare.

-

National Center for Health Statistics (1975) Deaths from 69 selected causes: United States, each division and state—1975. Vital and Health Statistics of the United States . Washington, D.C. U.S. Department of Health, Education, and Welfare.

-

Niskanen, W. A. (1962) The Demand for Alcoholic Beverages: An Experiment in Econometric Method . P-2583. Santa Monica, Calif.: Rand Corporation.

-

Ornstein, S. I., and Levy, D. (ca. 1978) Price and income elasticities of demand for alcoholic beverages. Graduate School of Management, University of California, Los Angeles.

-

Polich, J. M., and Orvis, B. (1979) Alcohol Problems: Patterns and Prevalence in the U.S. Air Force . Santa Monica, Calif.: Rand Corporation.

-

Popham, R. E., Schmidt, W., and deLint, J. (1976) The effects of legal restraint on drinking. In B. Kissin, editor; and H. Begleiter, editor. , eds., Social Aspects of Alcoholism , Vol. 4. New York: Plenum Press.

-

Popham, R. E., Schmidt, W., and deLint, J. (1978) Government control measures to prevent hazardous drinking. In J. A. Ewing, editor; and B. A. Rouse, editor. , eds., Drinking . Chicago: Nelson-Hall.

-

Schmidt, W. (1977) The epidemiology of cirrhosis of the liver: A statistical analysis of mortality data with special reference to Canada. In M. M. Fisher, editor; and J. G. Rankin, editor. , eds., Alcohol and the Liver . New York: Plenum Press.

-

Schmidt, W., and Popham, R. E. (forthcoming) Skog's "lagged" consumption variable: A comment on liver cirrhosis mortality as an indicator of heavy alcohol use. British Journal of Addiction .

-

Seeley, J. R. (1960) Death by liver cirrhosis and the price of beverage alcohol. Canadian Medical Association Journal 83:1361–1366. [PMC free article: PMC1939047] [PubMed: 13749627]

-

Simon, J. L. (1966) The price elasticity of liquor in the U.S. and a simple method of determination. Econometrica 43(1):193–205.

-

Skog, O.-J. (forthcoming) Liver cirrhosis mortality as an indicator of heavy alcohol use: Some methodological problems. British Journal of Addiction .

-

Smith, R. T. (1976) The legal and illegal markets for taxed goods: Pure theory and an application to state government taxation of distilled spirits. Journal of Law and Economics 19(2):393–429.

-

Terris, M. (1967) Epidemiology of cirrhosis of the liver: National mortality data. American Journal of Public Health 57:2076–2088. [PMC free article: PMC1227999] [PubMed: 6070248]

-

Waler, T. (1968) Distilled spirits and interstate consumption effects. American Economic Review 58:853–863.

-

Warburton, C. (1932) The Economic Results of Prohibition . New York: Columbia University Press.

-

Wonnacott, T. H., and Wonnacott, R. J. (1977) Introductory Statistics for Business and Economics , 2nd ed. New York: John Wiley & Sons.

- 1

-

See Bruun et al. (1975); Popham et al. (1976 and 1978); Medicine in the Public Interest (1979).

- 2

-

Details on state regulations are given in DISCUS (1977b).

- 3

-

A sufficient, but by no means necessary, condition for this prediction is that the commodity is "normal" (i.e., quantity demanded tends to increase with income).

- 4

-

Presumably retail price decisions are influenced by prices charged by manufacturers and importers, which will in turn be influenced by demand conditions. Demand should play a particularly important role in determining the price of aged whiskey and wine, which are in more or less fixed supply in the short run. If observed prices are influenced by demand conditions, rather than being an exogenous determinant of quantity demanded (as Johnson and Oksanen, and most other econometric studies, have assumed), then the parameter estimates in their demand equations will be biased and inconsistent. This is an example of a widely recurring problem in statistical analyses of data generated by a "natural" process characterized by complex causal interactions among the variables.

It should also be noted that Johnson and Oksanen use data on average prices of alcoholic beverages. It would be preferable to use price index data in this type of study, but alcoholic beverage price indexes are not available for Canadian provinces.

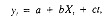

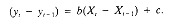

- 5

-

By way of illustration, the first difference form of the equation

is

- 6

-

Note that a state may be a net exporter across one border and an importer across another. The magnitudes of cross-border flows depend on the price differences, the number of people who live on the higher-priced side of each border, and the effort devoted to enforcing the laws against this sort of cross-border purchase.

- 7

-

A number of other reviews of the econometric literature are available. Bruun et al. (1975, pp. 74–78) and Medicine in the Public Interest (1979, pp. 64–68) present nontechnical summaries. More detailed reviews are in Lau (1975) and Ornstein and Levy (ca. 1978).

- 8

-

The prices used for this calculation were taken from data in various issues of The Liquor Handbook on "retail prices of leading brands." Average prices for each state and year were calculated by ANOVA (analysis of variance), with main effects for each state and each brand. Separate ANOVAs were run for each year. The coefficients on the "state effects" were used as a measure of average price. (The null category for brand was Bacardi rum.)

To calculate the markup on tax changes. I proceeded as follows: For each year, price changes for all 30 license states were calculated and standardized by subtracting that year's median price change. The resulting net price changes for states with tax changes in that year were divided by the tax changes. The median of the 39 ratios calculated in this fashion was 1.1875, suggesting a "typical" markup of 18.75 percent. This estimate was rounded to 20 percent in the elasticity calculations reported here.

- 9

-

Since no data were available for 1958, it was not possible to include the three states that had tax changes in 1961.

- 10

-

Not all cases of fatal cirrhosis are related to alcohol. Schmidt (1977) estimated that the death rate in Canada from causes other than excess drinking is about 4/100,000. If this "base rate" of alcohol mortality is applicable to the United States, then almost three-quarters of cirrhosis deaths are alcohol-related.

- 11

-

Schmidt (1977) reports evidence that drinkers who consume as little as three ounces of ethanol per day for long periods have a heightened risk of cirrhosis. A large percentage of those who die of alcohol-related cirrhosis have a drinking history that is more moderate than that of a clinical alcoholic population.

- 12

-

See Polich and Orvis (1979) for an analysis of the relationship between consumption level and the incidence of a variety of alcohol-related problems in a sample of U.S. Air Force personnel.

- 13

-

Economic theory and common sense both suggest that the price elasticity of demand for a normal commodity tends to be relatively high for households in which expenditures on the commodity constitute a relatively large fraction of their budgets.

- 14

-

A related bit of evidence is given in Terris (1967). He notes that, in England and Wales in 1950, the cirrhosis death rate increased strongly with socioeconomic class, unlike in the United States. His explanation is that "spirits have been taxed out of reach of the lower social classes in the United Kingdom, where only the well-to-do can really afford the luxury of dying of cirrhosis of the liver" (p. 2086).

- 15

-

Mortality rates for cirrhosis and auto accidents were calculated from frequency counts published in National Center for Health Statistics (1975, Table 1–13) and related tables in previous editions. Annual state population estimates were taken from Bureau of the Census (1971, 1978).

- 16

-

There is considerable evidence that the consumption levels of the median drinker and the, say, 90th percentile drinker are closely related, as demonstrated by comparing population groups that differ widely in per-capita consumption (Bruun et al. 1975). Hence it would appear that the consumption levels of the "typical" drinker and the "heavy" drinker are subject to the same environmental and cultural influences, and/or that drinking patterns are interdependent or "contagious."

- 17

-

See report of the panel, pp. 27–28.

- 18

-

Calculated from statistics reported in Polich and Orvis (1979, Appendix E). In making the calculations, I used the midpoints of each interval in Table E10 and assumed a mean of 20.0 for the top, open-ended interval.

- 19

-

Beer and on-premise consumption were not included in this study.

- 20

-

Consumers' surplus is defined as the maximum amount consumers would be willing to pay for their current consumption level, minus the amount they actually are required to pay. This difference is positive because consumers value inframarginal units of the commodity at more than their price, as reflected in the fact that demand curves have negative slope.

How Much Money Does The Government Make On Alcohol Taxes

Source: https://www.ncbi.nlm.nih.gov/books/NBK216412/

Posted by: velezhavenou.blogspot.com

0 Response to "How Much Money Does The Government Make On Alcohol Taxes"

Post a Comment